Unlocking the value of public wealth

McKinsey & Company

The Concept/

Public Wealth

Public commercial assets are the biggest wealth segment in the world – and probably the least well understood.

Trillion (USD), global public assets

Governments worldwide own vast assets, with a total value above all global capital markets combined. In total they are worth 2xglobal GDP, or USD 200 trillion. Yet this much more valuable pool of assets – around twice the value of all listed companies – receives far less attention than the world’ s stock of listed companies.

Indeed, only very few governments make any serious efforts to record and value all their commercial assets in annual accounts, and even those that do apparently fail to capture large swathes of public assets in their assessments, with the result that the true value of public commercial assets is probably much higher than the IMF assessment, which relies on government data.

Such a dearth of information and governance, in comparison with private sector norms, can only promote inefficiency, and the IMF study estimates a cost to this – around 1.5% of the total value of assets per year.

Trillion (USD), global government-owned real estate

Government-owned real estate is the largest segment of public commercial assets, and the government is the single largest property owner in any country. Its real estate portfolio is at least of the same magnitude as that of the entire private sector combined and most likely above 1x GDP or USD 100 trillion

Trillion (USD), extra revenues from assets – each year

Professionally managed public assets could probably generate additional revenues equal to USD 5 trillion.

At a time when governments need to deploy enormous resources to meet the challenges of climate change, professionalising public asset management would generate additional fiscal space that could help pay for the required investments.

BCG – Boston Consulting Group

Copenhagen follows the MTR-example in Hong Kong and shows that professional management of public real estate in a holding company could help fund infrastructure.

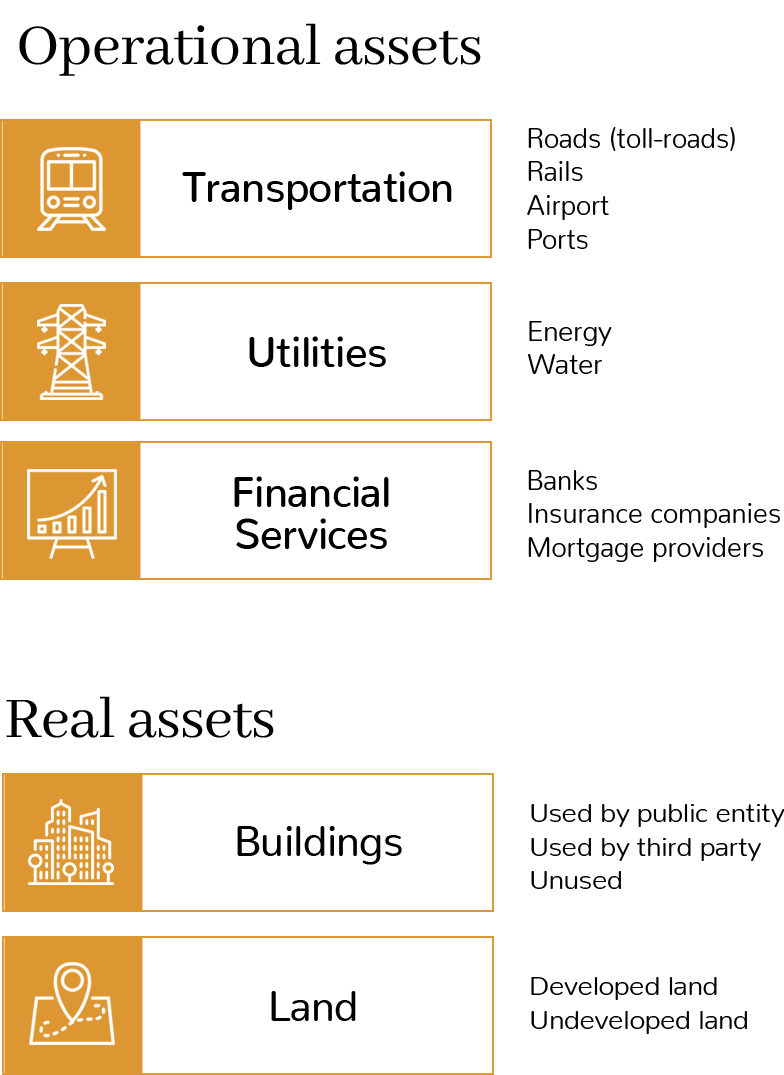

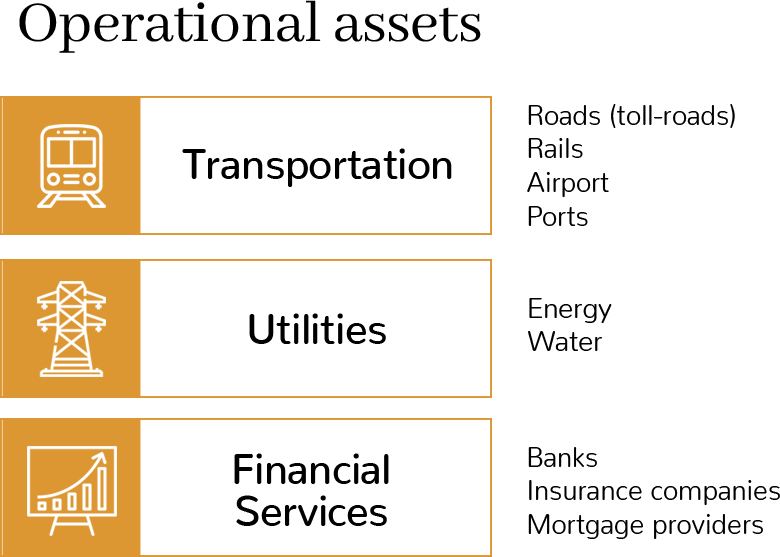

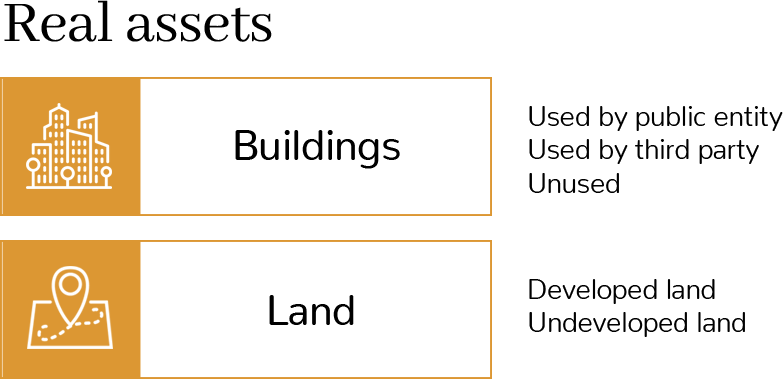

Public Commercial assets

Commercial assets – those that can generate revenues, if managed professionally

Public Commercial assets

Commercial assets – those that can generate revenues, if managed professionally

The Boston-example demonstrates how governments are mismanaged due to poor accounting. It is a recipe for poor governance, if not outright corruption.

Read more how government accounting is creating bad governance –

The Boston-example demonstrates how governments are mismanaged due to poor accounting. It is a recipe for poor governance, if not outright corruption.

Read more how government accounting is creating bad governance –

Chicaco Council on Global Affairs

Endorsements of Public Wealth

THESE ARE SOME OF THE ENDORSEMENTS FROM WELL KNOWN EXPERTS WITHIN THE FIELD

A must-read for all mayors, city counselors and those who elect them

“Drawing on the successes and failures of cities around the world and applying exemplary analysis, Detter and Fölster uncover a treasure trove of hidden urban assets. Transparent, accountable, and professional governance of the economic, social, and human assets of our cities is achievable. A must-read for all mayors, city counselors and those who elect them.”

– WILLEM H. BUITER, SPECIAL ECONOMIC ADVISER TO CITI

How to turn around distressed cities

“Across the globe, people are flocking to cities. But some cities are thriving and others aren’t. As the process of urbanization continues, it’s crucial to understand why some cities succeed and others don’t. In this important and practical new book, Detter and Fölster teach us how to turn around distressed cities.”

– PETER ORSZAG, VICE CHAIRMAN OF INVESTMENT BANKING, LAZARD, AND FORMER DIRECTOR, CONGRESSIONAL BUDGET OFFICE

a wake-up call for governments to become more responsible in managing their citizen’s wealth and securing the foundation for future generations

“Governments around the world have been acting recklessly in managing their public wealth, which is the key ingredient for securing the welfare of their citizens. This provocative book is a wake-up call for governments to become more responsible in managing their citizen’s wealth and securing the foundation for future generations.”

– MARCEL FRATZSCHER, PRESIDENT OF DIW BERLIN, PROFESSOR AT HUMBOLDT-UNIVERSITY, AND MEMBER OF THE ADVISORY COUNCIL OF THE MINISTRY OF ECONOMY OF GERMANY

Improving its management is one of the most important economic issues of our time.

“Public wealth is vast, but largely overlooked as an asset class. Improving its management is one of the most important economic issues of our time. Dag Detter and Stefan Fölster shed much light on the subject. One can only hope that their book will kickstart a debate that ushers in better stewardship of state land, buildings, utilities and other assets. The potential gains are enormous.”

– MATTHEW VALENCIA, THE ECONOMIST

There should be no excuse for those in power to dismiss these ideas.

“At a time of mistrust in traditional politics and weak public finances, Dag Detter and Stefan Fölster show politicians the way to demonstrate they are on the side of the people and to manage government assets better. There should be no excuse for those in power to dismiss these ideas.”

– CHRIS GILES, ECONOMICS EDITOR OF THE FINANCIAL TIMES

A must-read for all mayors, city counselors and those who elect them

“Drawing on the successes and failures of cities around the world and applying exemplary analysis, Detter and Fölster uncover a treasure trove of hidden urban assets. Transparent, accountable, and professional governance of the economic, social, and human assets of our cities is achievable. A must-read for all mayors, city counselors and those who elect them.”

– WILLEM H. BUITER, GLOBAL CHIEF ECONOMIST, CITI

How to turn around distressed cities

“Across the globe, people are flocking to cities. But some cities are thriving and others aren’t. As the process of urbanization continues, it’s crucial to understand why some cities succeed and others don’t. In this important and practical new book, Detter and Fölster teach us how to turn around distressed cities.”

– PETER ORSZAG, VICE CHAIRMAN OF INVESTMENT BANKING, LAZARD, AND FORMER DIRECTOR, CONGRESSIONAL BUDGET OFFICE

a wake-up call for governments to become more responsible in managing their citizen’s wealth and securing the foundation for future generations

“Governments around the world have been acting recklessly in managing their public wealth, which is the key ingredient for securing the welfare of their citizens. This provocative book is a wake-up call for governments to become more responsible in managing their citizen’s wealth and securing the foundation for future generations.”

– MARCEL FRATZSCHER, PRESIDENT OF DIW BERLIN, PROFESSOR AT HUMBOLDT-UNIVERSITY, AND MEMBER OF THE ADVISORY COUNCIL OF THE MINISTRY OF ECONOMY OF GERMANY

Improving its management is one of the most important economic issues of our time.

“Public wealth is vast, but largely overlooked as an asset class. Improving its management is one of the most important economic issues of our time. Dag Detter and Stefan Fölster shed much light on the subject. One can only hope that their book will kickstart a debate that ushers in better stewardship of state land, buildings, utilities and other assets. The potential gains are enormous.”

– MATTHEW VALENCIA, THE ECONOMIST

There should be no excuse for those in power to dismiss these ideas.

“At a time of mistrust in traditional politics and weak public finances, Dag Detter and Stefan Fölster show politicians the way to demonstrate they are on the side of the people and to manage government assets better. There should be no excuse for those in power to dismiss these ideas.”

– CHRIS GILES, ECONOMICS EDITOR OF THE FINANCIAL TIMES

Further reading

By DAG DETTER & Stefan fölster

This book shows that public wealth is vast and could be put to much better use. Most countries’ public wealth is larger than their public debt. The polarized debate between privatizers and nationalizers has missed the most important point – the quality of asset management.

THE ECONOMIST & FINANCIAL TIMES

BEST BOOK OF THE YEAR / 2015

NEWS

Follow along

Putting Public Assets to Work

Dag Detter & Shayne Kavanagh

Why Public Assets are Key to Debt Sustainability: A Moral Goal

Ian Ball, Dag Detter, Yannis Manuelidis and Wang Yan

How Smart Public Assets Management Can Drive the Post-COVID-19 Recovery

Ian Ball, Hanan Amin-Salem and Dag Detter

How public assets can help revive Lebanon

Dag Detter and Nasser Said

A Stronger Recovery Through Better Accounting

Willem Buiter, Ian Ball and Dag Detter

Public Assets Are an Untapped Source of National Wealth

Dag Detter

![]()